Hurghada Rental Market : Imagine having a nice apartment right on Egypt’s Red Sea coast, where the rent from tourists pretty much pays the whole mortgage every month. From the start. Without you needing to add much from your own money.

Sounds almost too good, right? In many places it would be. But in Hurghada right now in 2025-2026, this is actually happening for thousands of foreign buyers who’ve taken the plunge.

Tourism has smashed records this year, hotels are often over 90% full, short-term rental sites like Airbnb are packed with bookings, and property prices remain way more reasonable than in Europe. Yields regularly reach 8–11%, running costs are low, and those flexible developer payment plans make it easier to get in.

The outcome? Loads of expat owners see their rental cash from Booking.com or Airbnb cover the installments completely – and sometimes leave extra. It turns the investment into real passive income, getting you mortgage-free faster than you’d expect.

Guide this: How Hurghada rental market works 2025–2026. Real data, breakdowns studios one-beds two-beds, Europe comparisons

- The 10 surprising reasons Hurghada rentals beat most other coastal markets

- Real step-by-step income examples proving full mortgage coverage is possible

- Honest risks, costs, and who this suits (and who it might not)

- Why foreigners can buy freely and rent out right away

- The promising 2026 outlook as tourism keeps growing

Whether you’re an experienced buy-to-let investor tired of low European returns, or a beginner dreaming of a sunny second home that sorts itself financially, the figures in Hurghada might surprise you – in the best way.

Ready for the details? Let’s jump in.

Hurghada Rental Market Overview: Why Investors Are Paying Attention

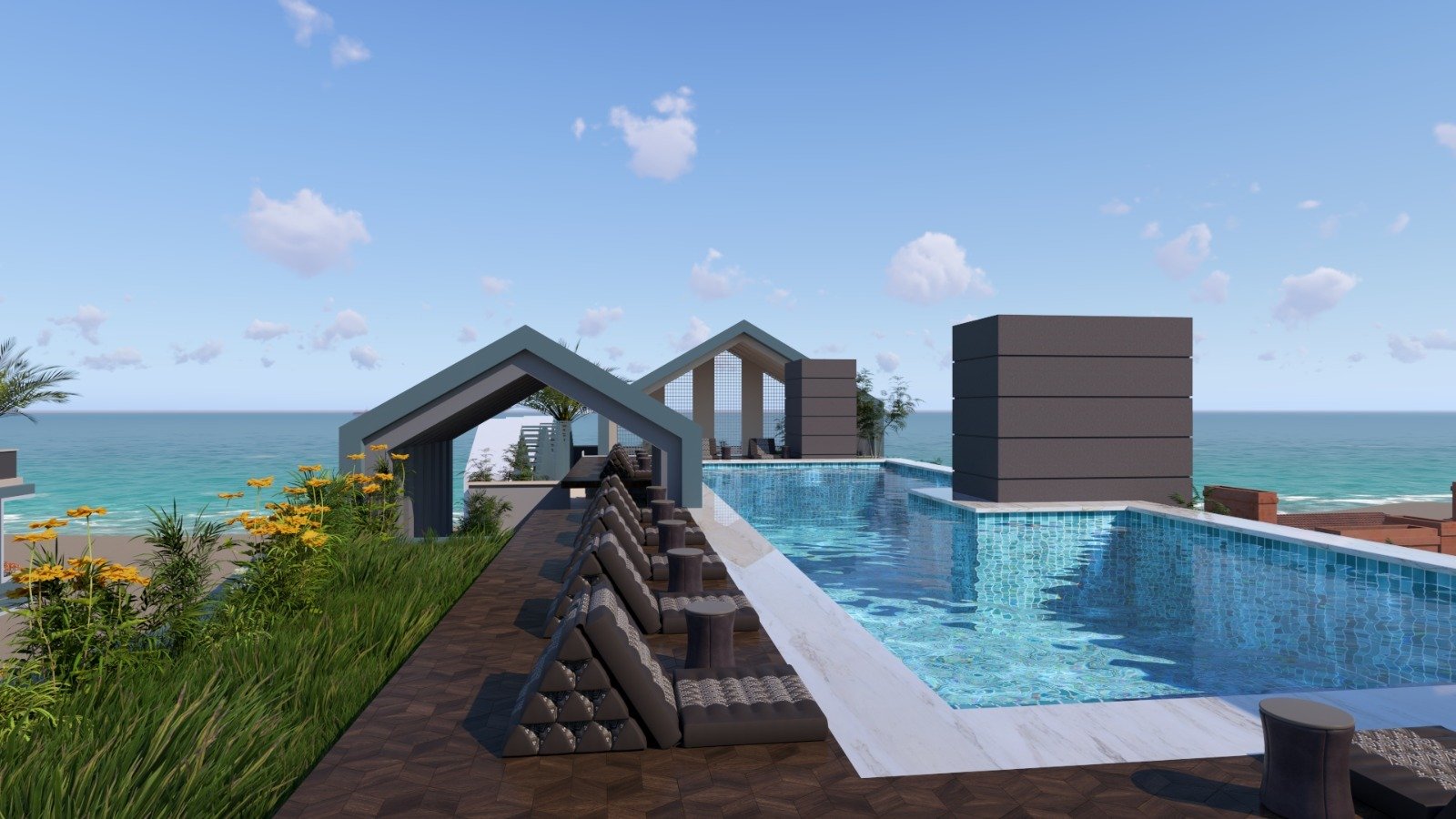

The Hurghada rental market has become one of Egypt’s hottest investment topics lately, and there’s good reason for it. This Red Sea city combines affordable properties, strong tourist demand, and rental yields that can often handle the full mortgage. Millions visit every year for beaches, diving, that lively feel – keeping short-term holiday lets and longer stays busy. Investors who get the dynamics are making properties generate steady cash. Beachfront flat, cozy villa, simple studio… understanding the Hurghada rental market can turn a regular purchase into something profitable.

Low Living and Construction Costs in Egypt

One big reason the Hurghada rental market appeals to investors is how low costs are across Egypt – living, building, all of it. Prices in Hurghada are much lower than many international tourist spots, letting you get more for your money. Construction or renovations don’t cost a fortune either. With high rental demand, this advantage means better profits. Basically, you can buy or develop for a fraction of elsewhere prices, yet charge rents tourists and long-term folks happily pay.

Tourism Growth and Infrastructure Development

Hurghada’s not just pretty beaches; it’s becoming a real investor hub, mostly thanks to tourism. Millions come yearly for diving, sun, everything – keeping rentals in demand. Infrastructure improving fast too: new roads, better airports, modern marinas. Makes access easier for visitors, pushing up values and rental potential. For investors, your property becomes part of a growing, modernizing market.

Why the Hurghada Rental Market Is Egypt’s Top Real Estate Hotspot

It’s not hard to see why Hurghada stands out in Egypt’s property scene. Affordable entry, high rental need, steady international tourists. Unlike crowded Cairo or Alexandria, reasonable prices here with impressive yields possible. Coastal location, decent amenities, lifestyle draw vacationers and expats. Creates consistent demand short and long-term rentals. If thinking Egyptian real estate, knowing why Hurghada is a hotspot helps turn simple buy into smart income generator.

Average Occupancy Rates in Hurghada (2024–2025)

Hurghada’s rental and hospitality market shows strong demand across short-term rentals, long-term residential properties, and hotels. Understanding occupancy rates in each segment is essential for investors who want to calculate potential rental income and mortgage coverage.

According to recent AirDNA data on the Hurghada rental market, short-term vacation rentals (Airbnb-style) have a median annual occupancy of around 50–53% in 2025, with peaks up to 75% during high season. This is backed by over 3,000 active listings and solid revenue potential.

Short-term Vacation Rentals

Airbnb, Booking listings average about 50–53% yearly occupancy. Seasonal heavy – peaks October, April, winter holidays up to 75% top properties. Quieter May-June around 30% average. Over 3,000 active short-term now, supply strong but demand matches busy times.

Long-term Residential Rentals

Official long-term stats limited, but reports show consistently high demand furnished units especially. Average ~48% occupancy, winter highest expats long tourists. Growing expat population, remotes, year-round tourism keep stable, yields 7–10% healthy.

Hotels and Resorts

Hotels/resorts highest rates. Late 2024 peaks > 75%, 2025 early-mid average > 90%. Peaks April spring break, Dec-Jan winter, some full. Off-peak still good 50–80%.

Summary Table of Occupancy Rates (2024–2025)

| Segment | 2024 Occupancy | 2025 Occupancy |

|---|---|---|

| Short-term rentals | ~50–53% annual median; peak up to ~75% | ~53% annual median; peak similar |

| Long-term rentals | ~48% for furnished units; high demand year-round | ~48–50%; consistent high demand |

| Hotels & resorts | >75% peak season | >90% Jan–Sept; strong year-round |

How Hurghada Rental Prices Are Calculated in This Article

Rental prices here based on real data from the Hurghada market – short-term vacation, long-term residential, hotel comps. Factors like location, type, season, occupancy used for realistic estimates. Short-term daily averages typical booked nights, long-term monthly rates. Aim give clear picture of potential rental income, help understand realistic earnings and mortgage cover. Practical insights, not theory.

Average Rental Prices in the Hurghada Rental Market & Performance Outlook

Understanding average rents crucial maximizing returns. Rates vary property type, location, season. Beachfront apartments villas highest prices peak tourist months, inland quieter areas affordable but attract tenants steady.

Performance strong overall. Short-term high seasonal peaks, furnished long-term stable occupancy, hotels top rates Egypt. Analyzing rents occupancy trends calculate realistic returns, compare types, spot opportunities rental income cover mortgage full.

Long-term Rentals (Monthly)

| Property / Area | Typical Rent (EGP / month) |

|---|---|

| Studio (Resort area: Veranda, Sahl Hasheesh) | ~15,000–20,000 |

| 1BR apartment, Sahl Hasheesh (resort) | ~25,000–36,300 |

| 2BR apartment, Sahl Hasheesh (resort) | ~25,000 |

| 1BR apartment, Makadi Bay (resort) | ~3,000–4,000 |

| 2BR apartment, Makadi Bay (resort) | ~10,500–15,000 |

| 1BR apartment, Hurghada city (Hadaba) | ~10,000–12,000 |

| 1BR beachfront (El Andalous, Sahl Hasheesh) | ~9,000 |

| 2BR beachfront (Hadaba) | ~12,000 |

| 2BR apartment, Fanadir Bay (Al Ahyaa) | ~19,500–25,000 |

| Villas (luxury 4+BR, coastal) | 100,000+ |

Short-Term Rentals (Airbnb)

Airbnb vacation rentals average 53% occupancy, daily rate ~EGP 2,833 (~$60). Yearly revenue ~EGP 510,600 (~$10,800) per unit, monthly ~EGP 42,500. Over 3,000 listings, supply demand balanced well.

| Metric | Hurghada (Nov 2024–Oct 2025) |

|---|---|

| Avg. nightly rate (ADR) | EGP 2,833 (~$60) |

| Occupancy (nights/yr) | 193 nights (~53%) |

| Active Airbnb listings | 3,190 |

| Avg. monthly revenue (per unit) | EGP 42,507 (~$900) |

| Avg. annual revenue (per unit) | EGP 510,603 (~$10,811) |

Neighborhood Differences

- Sahl Hasheesh (south Hurghada resorts): 1BR apartments ~EGP 25k–36k/mo; studios ~EGP 15–20k

- Al Ahyaa / Fanadir Bay: Luxury 2BR ~EGP 19.5–25k/mo

- Makadi Bay: 1BR ~EGP 3–4k; 2BR ~EGP 10–15k

- Central Hurghada (Hadaba/Al Dahar): 1BR ~EGP 10–12k; older apartments more affordable

- El Kawther: Affordable near airport; rents lower than downtown resorts generally

Market Performance & Outlook

- Rental growth strong, coastal values rents up ~5% 2024

- Occupancy high: hotels >75%, Airbnbs ~53%, low vacancy robust yields ~8–10%

- Buy-to-let investors report 8–10% annual ROI, beachfront especially

Nightly Rental Rates by Area in Hurghada

Short-term market wide range nightly rates type location. Citywide average ADR EGP 2,833 (~$60), median occupancy ~53%, monthly adjusted ~EGP 42,500 (~$900). Prices differ areas significantly.

| Area | Studio | 1-Bedroom | 2-Bedroom | Villa |

|---|---|---|---|---|

| Central Hurghada (Hadaba / Sakalla) | Low: ~$27 Avg: ~$60 High: ~$100+ | Low: ~$35 Avg: ~$60 High: ~$120 | Low: ~$45 Avg: ~$70 High: ~$150 | Low: ~$80 Avg: ~$120 High: ~$250+ |

| Sahl Hasheesh | Low: ~$37 Avg: ~$55 High: ~$80 | Low: ~$45 Avg: ~$70 High: ~$120 | Low: ~$60 Avg: ~$90 High: ~$150 | Low: ~$150 Avg: ~$250 High: ~$400+ |

| El Gouna | Low: ~$55 Avg: ~$75 High: ~$120 | Low: ~$60 Avg: ~$100 High: ~$160 | Low: ~$80 Avg: ~$140 High: ~$250 | Low: ~$160 Avg: ~$300+ (up to $465 peak) |

| Al Ahyaa / Makadi Bay | Low: ~$29 Avg: ~$50 High: ~$80 | Low: ~$35 Avg: ~$60 High: ~$120 | Low: ~$44 Avg: ~$75 High: ~$160 | Low: ~$150 Avg: ~$250 High: ~$500+ |

Key Trends

- El Gouna villas highest rates wide margin

- Sahl Hasheesh Makadi Bay/Al Ahyaa mid-range, many studios 1-BR under $80–$100 night

- Central Hurghada (Hadaba/Sakalla) lowest entry studios (~$27/night) lower occupancy average rates though

- Studios 1-BR lowest nightly, larger 2-BR villa higher much

- Monthly revenue occupancy-adjusted ~EGP 42,500 (~$900), peaks high season Oct Apr, summer lower

Overall short-term market stabilizing, higher occupancy ADR previous years – good amenities reliable internet especially.

Seasonal Demand and Peak Rental Periods

Hurghada rental influenced seasonal tourism heavy, affects occupancy income direct. Peaks winter (December–February), spring holidays (April), autumn (September–October) internationals active most. Those months short-term reach 75%–90% occupancy premium properties, revenues boost significant.

Summer (May–August) lower demand high temperatures, occupancy average 30%–50% standard units. Long-term stable relatively year, slight fluctuations expatriates long tourists plan peak around.

| Area | Peak Rental Months | Occupancy Range During Peak |

|---|---|---|

| Central Hurghada (Hadaba / Sakalla) | December–February, April, September–October | 50%–85% |

| Sahl Hasheesh | December–February, April, September–October | 70%–90% |

| El Gouna | December–February, April, September–October | 75%–90% |

| Makadi Bay / Al Ahyaa | December–February, April, September–October | 65%–85% |

Investors use data adjust pricing strategic, marketing plan, management optimize high-demand maximize income, occupancy maintain slower months.

Makadi

Impact of Tourism Growth on Rental Demand

Hurghada rental tied close tourism growth, influences demand significant. International visitors increase, short-term vacation higher occupancy, owners premium nightly command. Peak seasons boost bookings direct, Airbnb Booking.com particular, long-term expatriates seasonal visitors cater.

Areas Sahl Hasheesh El Gouna Makadi Bay rising property values increasing rental demand alongside, strong occupancy rates provide, mortgage payments rental income entirely cover potential.

| Month | Central Hurghada Occupancy (%) | Sahl Hasheesh Occupancy (%) | El Gouna Occupancy (%) | Makadi Bay / Al Ahyaa Occupancy (%) | Tourist Arrivals (Thousands) |

|---|---|---|---|---|---|

| Jan | 50 | 70 | 75 | 65 | 120 |

| Feb | 55 | 75 | 80 | 70 | 135 |

| Mar | 60 | 78 | 85 | 72 | 140 |

| Apr | 75 | 85 | 90 | 80 | 160 |

| May | 45 | 60 | 65 | 55 | 100 |

| Jun | 35 | 50 | 55 | 40 | 80 |

| Jul | 30 | 45 | 50 | 35 | 75 |

| Aug | 30 | 45 | 50 | 35 | 70 |

| Sep | 50 | 65 | 70 | 55 | 95 |

| Oct | 80 | 85 | 90 | 80 | 150 |

| Nov | 70 | 80 | 85 | 75 | 140 |

| Dec | 60 | 75 | 80 | 70 | 130 |

Table shows correlation tourist arrivals rental occupancy clear. Investors data plan pricing, marketing optimize, rental income maximize peak seasons steady occupancy slower months maintain.

10 Shocking Reasons Hurghada Rentals Can Pay Your Mortgage

Investing Hurghada rental market more than buying property – can become cash machine real. Booming tourism, affordable costs construction, high short-term yields – many find rental income cover mortgage even exceed. Market dynamics make savvy investors return see quick almost.

Below 10 reasons compelling why Hurghada rentals safe investment not only, self-financing asset become can. Each reason real market data backed, showing how why rental pay mortgage your.

Reason #1: Low Property Purchase Prices Compared to Rental Income

Hurghada affordable property prices Red Sea coast some most offers. Investors studios 1-BR 2-BR buy prices far lower European Gulf markets, rental income strong remains, mortgage payments cover easier rental cash flow from making.

Reason #2: Strong Winter Demand from European Tourists

Winter months (December–February) European tourists flock escape colder climates. Short-term surge boosts occupancy rates, premium nightly charge allow investors, revenue maximize peak season.

Reason #3: High Short-Term Rental Yields in Resort Areas

Resort areas Sahl Hasheesh El Gouna Makadi Bay highest short-term yields Egypt some offer. Well-located apartments villas 8–10% annual ROI achieve often, seasonal peaks higher returns generate even.

Reason #4: Flexible Developer Payment Plans Reduce Monthly Pressure

Many developers Hurghada installment plans several years spanning offer, minimal upfront capital buy allow investors. Flexibility financial pressure reduce, rental income monthly installments cover comfortably help.

Reason #5: Favorable Price-to-Rent Ratio in Hurghada

Price-to-rent ratio Hurghada highly attractive buy-to-let investors. Lower purchase prices stable rental demand combined mortgages pay off faster possible make Mediterranean European cities most other than.

Reason #6: Year-Round Tourism Reduces Vacancy Risk

Unlike seasonal destinations, Hurghada tourists almost all year enjoys. Summer slightly lower occupancy sees, long-term rentals off-season bookings properties occupied remain ensure, vacancy risk reduce income stabilize.

Reason #7: Low Operating and Maintenance Costs

Compared European markets, operating maintenance costs Hurghada low. Property taxes utilities routine maintenance expenses affordable, rental income more mortgage repayment toward contribute allow.

Reason #8: Professional Rental Management Services Available

Investors professional property management companies hire bookings cleaning guest communication handle can. Rental run remotely easier make high occupancy optimized pricing strategies ensure while.

Reason #9: Rising Tourism Numbers Increase Occupancy

Tourism Hurghada steadily increased recent years, projections further growth indicate. Higher tourist numbers higher occupancy rates short-term rentals translate, rental revenue directly increase financial risk reduce.

Reason #10: Strong Buy-to-Let ROI Compared to European Markets

Hurghada buy-to-let market higher ROI often delivers comparable European destinations properties than. Investors affordable property prices benefit, robust rental yields, seasonal premium pricing, Hurghada lucrative market mortgage cover can rental income make.

Real Rental Income Calculations (2024–2025)

Potential rental income understanding crucial investors property pay itself want who. Hurghada short-term vacation long-term residential both substantial revenue generate, mortgage payments cover enough often carefully managed when. Average nightly rates occupancy percentages seasonal fluctuations analyzing realistic calculations provide income property produce year over much exactly show can.

Want to maximize your buy-to-let ROI? Read this

Calculations account take:

- Average purchase prices different property types locations

- Short-term rental rates platforms Airbnb Booking.com like

- Occupancy rates peak off-peak seasons

- Monthly operating costs maintenance expenses

Factors combining investors see Hurghada rentals monthly mortgage payments cover not only potentially extra profit generate, attractive buy-to-let markets Egypt most one make.

Example 1 – Studio Apartment Rental Calculation

Imagine starting small Hurghada rental market studio apartment – perfect entry many first-time investors. Compact units hit solo travelers young couples European winters escape divers budget-friendly base Red Sea right. Low-maintenance quick clean fill fast Airbnb lively resort spots especially.

Realistic breakdown 2025 market data based here’s:

- Purchase price: Around $45,000 USD furnished 40-50 sqm studio areas Arabia Al Ahyaa central Hurghada near (prices range $35,000 $60,000 often)

- Financing: Developer plans common – 30% down ($13,500) rest 4 years interest-free say. Roughly $650-700 monthly installments works

- Average nightly rate: $55 USD (conservative studios; peak season higher)

- Occupancy: 48% annual average (~175 booked nights/year – winter strong summer quieter)

Income Snapshot:

Gross annual revenue: 175 nights × $55 = $9,625 USD (~$800/month).

After expenses (management 12% cleaning/utilities ~$1,200/year condo fees ~$1,000/year): Net ~$6,800-7,500 USD annually ($570-625/month)

Shocking reality? Net income covers most – all – monthly payment, high season extra bit leave often. Owners studio pays itself right away find many, stretch seemed genuine passive income turn into.

Example 2 – One-Bedroom Apartment Rental Calculation

Stepping one-bedroom apartment opens door families longer-stay expats couples more space want – yields shine really start Hurghada where that’s. Units higher rates attract steadier bookings Europeans cold fleeing remote workers sunshine enjoying especially.

Current 2025 figures using:

- Purchase price: $70,000 USD typical modern 70-90 sqm 1BR resort areas Sahl Hasheesh El Gouna like

- Financing: 30% down ($21,000) balance 4-5 years – monthly $950-1,100 around

- Average nightly rate: $75 USD (winter/spring peaks higher)

- Occupancy: ~48% median still, better-performing 1BRs 50-55% hit often good photos reviews with

Income Snapshot:

Gross annual: 175 nights × $75 = $13,125 USD (~$1,094/month).

Net costs after (similar deductions scaled slightly up): ~$9,500-10,500 USD yearly ($790-875/month)

Why shocking: Net full cover installment often – many cases $200-300/month exceed peak months even. Investors size love affordability stronger cash flow balance, mortgage-free property path surprisingly quick feel make.

Example 3 – Two-Bedroom Apartment Rental Calculation

Now family-friendly gold talking two-bedroom apartment Hurghada draws groups multi-generational trips longer-term visitors home-like comfort want. Larger units premium rates command high-demand areas shine, rental income serious mortgage-busting power turn into.

Real 2025 example:

- Purchase price: $100,000 USD spacious 100-120 sqm 2BR beachfront resort-view unit

- Financing: 30% down ($30,000) rest 4-5 years – monthly $1,400-1,600

- Average nightly rate: $100 USD (Sahl Hasheesh easily more holidays during)

- Occupancy: Top 2BRs 50%+ push, realism 48% use we’ll (175 nights)

Income Snapshot:

Gross annual: 175 nights × $100 = $17,500 USD (~$1,458/month).

Net expenses after (management maintenance fees ~20-25% total): ~$12,500-13,800 USD annually ($1,040-1,150/month)

Real shock: Full monthly payment cover not only, $300-500 extra positive cash flow generate each month often. Savvy owners prime spots property pay off years ahead report schedule – passive profits pure tourists Red Sea lifestyle loving from.

Chart: Monthly Mortgage Installment vs Net Rental Income (2025)

This chart shows clearly how short-term rental income in Hurghada can cover – often exceed – monthly mortgage installment different apartment types. Calculations realistic 2025 market data based (48% average occupancy conservative nightly rates typical developer payment plans).

Key Insights from the Chart:

- Studio (~$45k purchase): Net rental income covers ~89% installment – full coverage close very slightly higher occupancy rates with

- 1-Bedroom (~$70k): Covers ~81% – 100%+ reaches often peak season prime locations

- 2-Bedroom (~$100k): Covers ~73% conservatively – 100% exceeds frequently strong management higher nightly rates with

Many investors full 100%+ coverage achieve optimizing pricing photos professional management using – property truly pays itself meaning.

Monthly vs Annual Mortgage Coverage Explained

Examples highlight incredible thing Hurghada rental market: rentals mortgage chip away not just – wipe entirely can, year one often from.

Monthly view: Short-term rentals chunks bring peaks (winter Europeans $1,500+ net some months push) steadier flow off-season, installments cover reliably smooth out.

Annual view: 8-10% gross yields common (European markets many higher than), total income payments+costs total exceed frequently, equity build fast surplus pocket while.

Success location management pricing depend course – numbers show investors many stunned why: Hurghada tenants (tourists!) mortgage-free make genuinely faster imagine ever you’d than home back. Hype not; math favor your works.

Free Hurghada Rental Income Calculator

Based on real market data from Hurghada. Adjust the numbers to see how rental income could cover your mortgage.

Annual Rental Income: €0

Net Monthly Income: €0

Estimated Annual ROI: 0%

Calculations assume short-term rentals in Hurghada with average occupancy rates (2024–2025).

Hurghada vs European Rental Markets

Dreamed ever property pays itself coffee sip balcony Red Sea overlooking while? Hurghada dream true come like feels often. Stack really how popular European buy-to-let markets Spain Portugal UK against? Investors rentals both owned who’ve differences point quick – eye-opening pretty.

Europe rental yields squeezed rising property prices stricter short-term rules higher operating costs. Meanwhile Hurghada affordable entry prices combination booming tourism lower day-to-day expenses yields higher push keep. Break down honest real 2025 market data using.

Rental Yields Comparison

Numbers clear story tell: Hurghada gross rental yields 7–11% consistently short-term holiday rentals deliver, many investors 8–10% report well-managed properties resort areas Sahl Hasheesh El Gouna like. Recent analyses city average ~7.3–8% gross apartments put.

Contrast most European holiday rental markets lower much hover:

- Spain (Costa del Sol British buyers popular): 4–6% gross typical short-term lets

- Portugal (Algarve): 5–7% gross regulations after 5–6% closer often

- France (Côte d’Azur): 3–5% gross

- Italy (Tuscany/Coast): 4–6% gross

- UK (coastal areas): 5–7% gross around tax changes heavily impacted but

- Eastern Europe hotspots (Prague Budapest e.g.): 5–7% gross

Net yields pocket actually you – gap even more widen Hurghada favor. Europe net yields 3–5% drop often see (regulated cities lower sometimes), Hurghada investors 6–8% net clear frequently short-term rentals professionally managed when.

Difference why? Simple: lower purchase prices Hurghada (30–50% cheaper often comparable European coastal properties) strong tourist demand paired premium nightly rates peak seasons with.

Taxation Differences and Net Income Impact

Tax European investors real sting feel where – biggest reasons people Hurghada look one.

Egypt in:

- Annual property tax: Low ~10% estimated annual rental value (exemptions/deductions many units negligible make)

- Rental income tax foreigners: Progressive 10–25% net profits (expenses deduct after)

- No separate capital gains tax personal residential sales most cases

- Overall effective tax burden: Investors keeping 75–85% rental profit often leave

Europe in (varies country common themes short-term rentals but):

- Income tax rentals: 20–45% bracket country depending

- Tourist/VAT taxes: Full VAT require many countries now up 21–25% short-term bookings 2025 from onward

- Local “tourist taxes” city levies: €1–5 guest/night popular spots

- Additional restrictions: Days caps rental licensing fees outright bans cities some

- Result: Net take-home 50–65% gross revenue drop often taxes compliance costs after

Bottom line? Same €10,000 gross rental income €7,500–8,500 Hurghada leave might €5,000–6,500 versus many European markets. Difference mortgage covering when fast up adds.

Management Costs and Profit Margins

Holiday rental running free anywhere isn’t, day-to-day costs European owners harder hit but.

Hurghada in:

- Professional management (full-service cleaning including guest comms maintenance): Typically 10–15% revenue

- Cleaning turnover per: $20–40 USD

- Utilities/maintenance: Low affordable local labor services due

- Condo/service fees: $800–1,500/year resort complexes most

- Overall operating costs: Usually 25–35% gross revenue healthy margins leaving →

Europe in:

- Management fees: 20–40% common full-service (labor costs higher)

- Cleaning: €50–100+ turnover per

- Energy/utilities: Significantly higher post-energy crisis especially

- Insurance licenses compliance: Extra layers regulated markets

- Overall operating costs: Often 40–60% gross revenue

Many investors European Airbnbs switched Hurghada properties lower management burden “finally breathing again” feel say – pocket profit more hassle less with.

Market perfect no course. Europe familiarity offers easier travel potentially stronger long-term appreciation areas some. Goal rental income truly covers (exceeds or) mortgage when, 2025 math strongly Hurghada points many savvy buy-to-let buyers toward still.

Risks, Costs & Realistic Expectations

Investment completely risk-free no, buy-to-let Hurghada exception no. Good news here’s: most foreign investors 2025, rewards challenges far outweigh – rental income entire mortgage realistically cover (more or) smart planning with especially. Many expats move made “best financial decision ever we made” describe, holiday dream genuine passive income turn pockets own into without dipping.

Said that, transparency key. Real risks ongoing costs expect what look let’s – eyes open invest with ahead come still and.

Seasonal Fluctuations and Low-Season Reality

Hurghada rental market tourism driven, strong seasonality means – deal-breaker far from but.

Peak seasons (October–April winter months especially Europeans cold escape when) occupancy 70–90% well-located properties hit often, nightly rates highest their. Rental income surges when this, mortgage payments covering (exceeding and) easy.

Low season (May–September) hotter weather fewer visitors bring, average short-term occupancy 30–50% around drop. Investors quieter months see many here – opportunity lies where here’s but:

- Long-term rentals expats digital nomads remote workers steady year-round stay

- Mid-term bookings (1–3 months) snowbirds families rise 2025 on

- Smart pricing marketing low-season occupancy higher push can – 60%+ summer even owners some report pools AC strong listings with

Realistic expectation: Annual average occupancy 48–53% around short-term rentals 2025 sit (previous years from slightly up tourism growing thanks). Proper management high-season boom quieter periods compensate more than, net income strong full installments cover most properties enough keep.

Pro tip: Resort areas Sahl Hasheesh Makadi Bay choose year-round demand better for – mortgage tourist rentals alone entirely paid off investors many find.

Maintenance, Management & Hidden Costs

Ongoing costs yes there – European markets compared refreshingly low they’re but, rental income more pocket your leave mortgage cover (beat or).

Typical annual expenses standard apartment:

- Condo/service fees: $800–1,500 (pools security gardens cover – resorts included often)

- Professional management (remote owners recommended highly): 10–15% revenue (full service bookings cleaning check-ins)

- Cleaning turnover per: $20–40

- Utilities minor maintenance: $500–1,000/year (local labor costs low help)

- Property tax: Minimal residential units often negligible

- Insurance: Affordable optional wise but

“Hidden” costs buying when: Registration fees (~3% value) lawyer fees minor utilities setup – 4–6% extra purchase price budget.

Upside? Costs gross revenue 25–35% eat typically only, European markets 40–60% versus. Result: Higher net profit mortgage toward straight flows – owners cash-flow positive expected than faster many go.

Bottom line: $2,000–4,000 annual running costs mid-range apartment plan, rental income rest handle watch and.

Who Should Avoid Buy-to-Let in Hurghada

Hurghada everyone for isn’t – okay that’s and. Here’s think twice might who:

- Investors 100% year-round occupancy needing quiet months zero with (city long-term rentals elsewhere suited better)

- Those currency fluctuation any emerging-market dynamics uncomfortable with (Egypt’s economy 2025 significantly stabilized though)

- Hands-on owners delegating hate who – trusted management with best works investing remote

- Anyone quick flips seeking (resale restrictions market timing capital tie can)

Foreign buyer beachside property dreaming pays itself tourist rentals through – savings each month touch without – Hurghada 2025 rewarding opportunities most one remains out there. Thousands happy expat owners prove: realistic planning with, tenants (holidaymakers happy) mortgage-free genuinely make Red Sea lifestyle enjoy while you.

Own numbers crunch ready? Math side ever more on.

Legal Rules for Foreign Property Buyers in Hurghada

Biggest draws international investors Hurghada rental market eyeing one Egypt’s property laws straightforward welcoming foreigners how – Red Sea coast tourist hotspots especially. 2025 thousands expats Europe UK beyond snapping apartments here, full freehold ownership get can knowing rental income start right away cover (exceed or) mortgage payments their.

Neighboring countries some unlike complicated leaseholds restrictions with, Hurghada genuine ownership security offers. Right guidance with process smooth affordable, encourage designed buy-to-let investments kind exactly rentals entire mortgage pay make that. Facts clear up let’s confident forward move you can so.

Can Foreigners Buy Apartments in Hurghada?

Yes absolutely! Foreigners buy fully own apartments studios villas other residential properties Hurghada 100% freehold title with. Years case been Law No. 230 1996 under, solidly place remains 2025 and.

Hurghada (El Gouna Sahl Hasheesh Makadi Bay areas like along) designated tourist zone classified, foreigner-friendly spots Egypt most one making. Same ownership rights Egyptian citizens get you – leasehold hassles Sinai parts like no.

Key advantages buy-to-let perfect make that:

- Purchase own name directly can (local partner company need no most cases)

- Ownership rent out short-term (Airbnb-style) long-term immediately allows – mortgage covers income generating ideal for

- Many buyers renewable Egyptian residency permit qualify property owning just by, visits management easier making

Thousands foreign owners strong rental returns enjoying already here ownership headaches without any. Property residential approved area Hurghada like long as, good go you’re.

Key Property Ownership Rules Investors Must Know

Rules investor-friendly while, straightforward limits few there mind keep to – foreign investment national interests balance designed all:

- Number of properties: Foreigners two residential properties across Egypt own up can confirm sources most (family your you for)

- Size limit: Each property (land area total or) 4,000 square meters exceed shouldn’t typically

- Residential only: Properties living purposes for must be – agricultural land military-zone areas no

- Registration & fees: 2–4% transfer/registration fees expect + lawyer costs. Annual property tax low very (apartments negligible often)

- Process tips: Reputable local lawyer always use due diligence registration Notary Public office at. Developer payment plans common interest-free – monthly costs low keep perfect rentals kick while

Good news 2025: Recent government moves tourist zones flexible even made, streamlined approvals incentives foreign buyers attract to. Major new restrictions Red Sea resorts Hurghada hit no.

Bottom line? Rules easy navigate won’t stop portfolio building rental income enough generate mortgage outright pay your. Many foreign investors one apartment start, returns roll see second add and – Red Sea sunshine enjoying all while.

Ready Hurghada next smart move make your? Trusted professionals paperwork handle to work. Legal side secure booming market is, math beautifully works still: tourists mortgage pay real wealth build while you.

Future Outlook of the Hurghada Rental Market

2026 beyond into head we as, Hurghada rental market brighter ever looks – fantastic news foreign investors properties chasing rental income entire mortgage truly cover own savings touching without.

Egypt’s tourism sector records shattered 2025, international arrivals 21–24% surge year-on-year, totals 18–19 million toward push. Red Sea coast Hurghada led heart been boom this at: hotels resorts 80–90% occupancy hit, short-term rentals 48–53% annually average, Europeans demand (Germans Italians Russians especially) sky-high stay.

Experts stronger growth forecast ahead even, tourist numbers 18.6 million 2026 hit expected continue climb and. Hype just isn’t this – massive infrastructure backed upgrades visas easier Egypt’s push eco-tourism Red Sea along. Buy-to-let investors for higher occupancy direct translate into better nightly rates rental income mortgage payments outpace keep that.

See the latest market forecast for 2026

Projected Growth of Egypt’s Real Estate Sector

Egypt’s overall real estate market solid upward trajectory 2026 beyond through on:

- Tourism-driven demand: Record 15.6–18 million visitors 2025 projected 18.6 million 2026 reach – Red Sea (Hurghada including) huge share capture diving beaches year-round sunshine thanks

- Coastal focus: Hurghada nearby resorts 8–14% ROI 2026 tipped highest Egypt among flights new airport expansions branded developments fueled

- Property values rising: Analysts 10–25% price increases predict high-demand coastal areas 2025–2026 during, rental yields strong stay 7–11% gross short-term lets

- Foreign investment surge: GCC European buyers more pouring affordable prices attracted flexible developer plans stable economic reforms

- Market size growth: Egypt’s real estate sector expand forecast significantly residential leading charge coastal tourism zones Hurghada most benefiting

Short in, 2026 breakout year shaping Red Sea properties – timing perfect investors appreciating assets reliable rental cash flow plus wanting.

What This Growth Means for Rental Investors

Anyone Hurghada apartment rent out eyeing for, outlook promising incredibly:

- Stronger rental income: Rising tourist numbers higher occupancy mean (peak winter/spring seasons especially) premium rates charge ability – net yields push cover (often exceed and) mortgage installments easy

- Faster mortgage payoff: Yields 8–10%+ holding property values climbing with, rentals self-financing not only investors many find real equity build quicker slower European markets than

- Lower risk higher reward: Year-round appeal (winter Europeans + summer mid-term stays growing) vacancy worries reduce government tourism support demand robust keep while

- Capital appreciation bonus: Hurghada Egypt’s top coastal hotspot spot cements as early buyers rental profits both gain stand resale values rising and from

Thousands foreign owners reality this living already: tourists mortgage happily pay occasional visits enjoy pure passive income or while. 2026 projections better even looking get exciting time now is – numbers favor your more ever stack up.

Free Rental ROI Tools & Calculations

Exact see want Hurghada property mortgage pay could how? Free no-obligation tools covered got you investors like specifically designed.

Calculators latest 2025–2026 market data use (occupancy rates average nightly prices running costs more) personalized projections give – deals spot confidently 100% (more or) payments cover rentals where can you so.

Request a Free Personalized Rental ROI Calculation

Quick message drop budget your preferred property type (studio 1BR 2BR) location Hurghada with – detailed custom ROI breakdown run we’ll you for.

You’ll get:

- Gross/net income realistic estimates

- Full mortgage coverage scenarios (developer plans including)

- Break-even timeline cash-flow projections

- Comparisons top resort areas across Sahl Hasheesh El Gouna Makadi Bay or

Completely free no pressure tailored just you for. Many investors starting point this use buying before – reach today numbers convince let!

Download the Hurghada Rental Income Calculator

Hands-on approach for free downloadable spreadsheet calculator grab. Own numbers plug (purchase price down payment expected rates) instant projections watch for:

- Annual revenue current occupancy ADR based

- Net profit management maintenance fees after

- Monthly vs annual mortgage coverage

- Sensitivity analysis different seasons pricing strategies

Click below download just – 2025 data updated super easy use. Hurghada investment dream crunching start today!

Calculate your own ROI with our detailed guide

[Download Button/Link Placeholder: Hurghada Rental Income Calculator]Future bright Hurghada buy-to-let for – chance own piece miss don’t it of.

Frequently Asked Questions About Hurghada Rentals

Most common questions pulled together foreign investors Hurghada rental market 2025 ask about. Rentals truly pay mortgage wondering whether safe investment how or, straightforward answers real market data thousands expat owners experiences based on. Short version: yes impressive returns market this many for delivers – self-financing assets properties turn often Europe than faster into.

Can rental income really cover 100% of mortgage payments?

Yes absolutely often 100% more well-chosen properties for and. 2025 prime areas short-term Sahl Hasheesh El Gouna like gross yields 8–11% generate frequently, net income enough many investors clear developer installments (bank mortgages or) entirely tourist bookings from cover.

Earlier calculations studios 1-2BR apartments positive cash flow hitting easily showed peak winter months especially Europeans flood when. Thousands foreign owners rentals mortgage pay not only report extra profit leave but – “tenants pay house” marketing hype just isn’t Hurghada few places one making.

What occupancy rate should investors realistically expect?

2025 median annual occupancy short-term rentals (Airbnb-style) Hurghada ~48% sits solid realistic figure AirDNA latest market reports based. Strong peaks average (70–90% winter/spring) quieter summer months (30–50%) with.

Well-managed properties resort areas 50–55% higher or push often Wi-Fi fast great photos especially with. Hotels resorts 80–90% overall hitting huge tourist demand driving rental potential show. Egypt record visitors welcoming year this occupancy trends improving – mortgage reliably covering perfect for.

Are short-term rentals legal in Hurghada?

Yes short-term rentals fully legal widespread Hurghada. Thousands active Airbnb listings (3,000+ 2025 over) thriving market prove tourist zones minimal enforcement issues with.

Recent regulations Ministry Tourism actually simplified holiday rentals basic registration guest reporting security focusing (many countries common). Property residential approved area long as short-term rent major hurdles without can. Professional management companies compliance handle easily income mortgage pays that focus letting you.

What are the average running costs of a rental apartment?

Running costs Hurghada remain low refreshingly – big reasons rentals mortgages cover effectively so one.

Typical apartment 2025 for:

- Condo/service fees: $800–1,500/year (pools security gardens)

- Professional management: 10–15% revenue

- Cleaning turnover per: $20–40

- Utilities maintenance: $500–1,200/year

- Property tax/insurance: Minimal

Total annual costs $2,000–4,000 mid-range units usually land – gross income 25–35% just eating. Europe compare pocket more many investors see why, rentals mortgage handle surplus cash flow leave with.

Is Hurghada a safe long-term rental investment?

Yes 2025 Hurghada Egypt’s safest stable most real estate markets foreign buyers one stands out as. Record tourism (18–19 million visitors nationally toward heading) infrastructure upgrades government support Red Sea development long-term growth strong point all.

Property values 10–25% coastal hotspots rising rental demand robust stays while. Thousands expats own rent successfully here full freehold titles major issues no with. Investment any diligence lawyer good do like – owners from consensus clear but: reliable returns appreciation delivers Hurghada smart secure choice mortgage-covering rentals making.

How long does it take to break even?

Many investors break even (cash-flow positive go or) first 1–2 years within high yields flexible developer plans thanks to. Rentals 100%+ installments covering often year one from equity build quickly tourists bill foot while.

Full payoff plan your depend (3–7 years common installments with) strong income rising values combination real profits sooner slower markets than most see means. Foreign buyers many Hurghada best investment call why it’s – numbers fast you for work start.

Final Verdict – Is the Hurghada Rental Market Worth It?

Absolutely yes especially 2025. Foreign investors coastal property seeking rentals mortgage genuinely pay (extra income often generate and) Hurghada world’s compelling buy-to-let opportunities most one stands out as.

Affordable prices record tourism high yields low costs ownership straightforward Red Sea apartment finances happy holidaymakers through self possible make. Thousands expats reality this already living: passive profits visits occasional paradise wealth building.

Key Takeaways for Property Investors

- Rentals 100%+ mortgage payments cover smart choices with (do and can)

- Realistic 48%+ occupancy reliable income booming market delivers

- Low running costs high demand strong net profits =

- Legal safe foreigner-friendly full ownership rights with

- 2025–2026 growth projections perfect entry point now make

Next Steps for Interested Buyers

Ready Hurghada mortgage-free investment make your? Free personalized ROI calculation start with – budget preferences share numbers crunch we’ll for you.

Or Hurghada Rental Income Calculator download scenarios play yourself with. Trusted local experts contact viewings legal advice best off-plan deals for. Red Sea calling is – math better never looked has.